Your vehicle reimbursement partner.

Get fully-managed, tax-free vehicle reimbursements for your employees who drive their personal cars.

Your fully-managed solution.

Build flexible vehicle reimbursement programs optimized to scale. Offer your team fair market benefits with easy-to-use software. Save all stakeholders time and tax dollars.

Solutions for your team

Finance

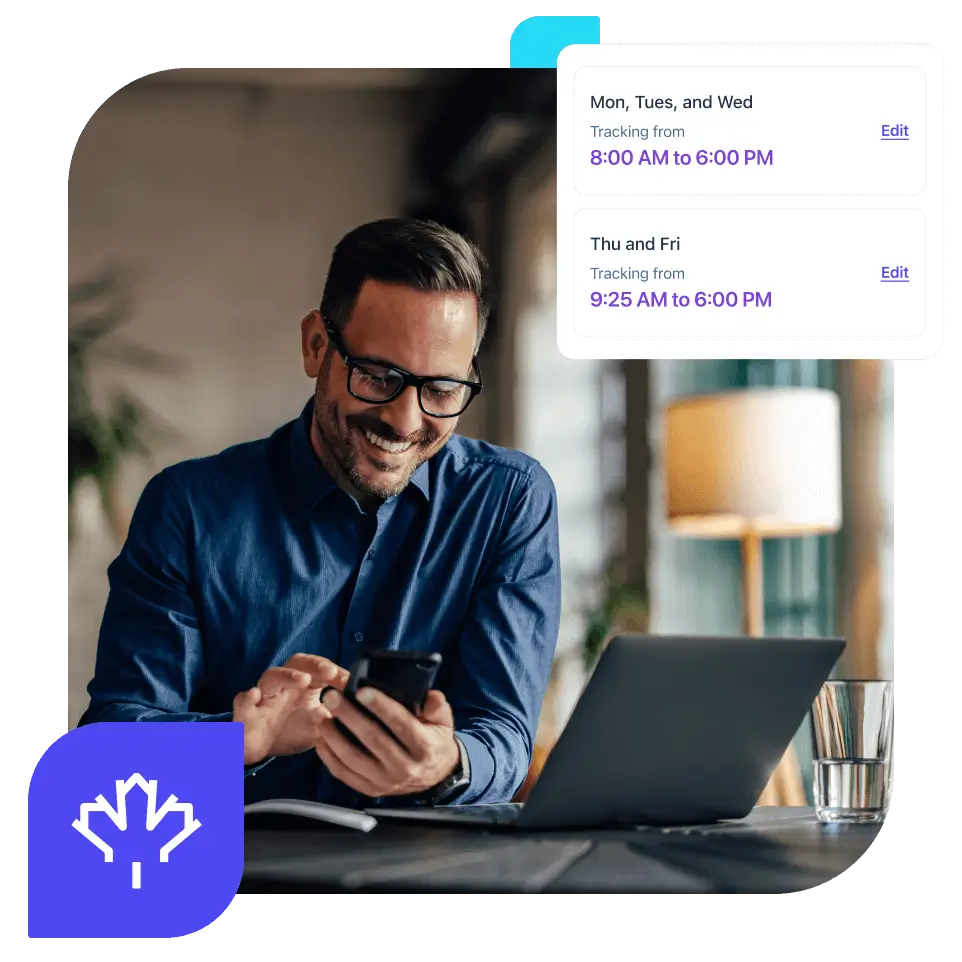

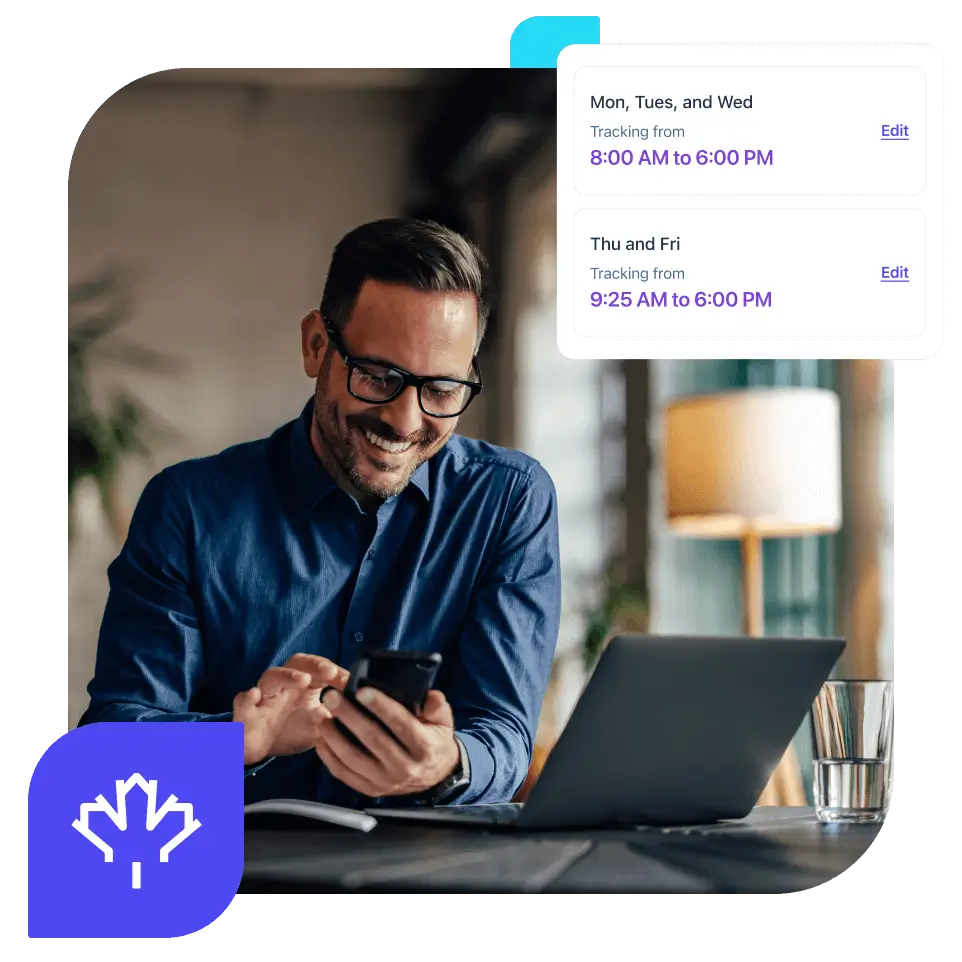

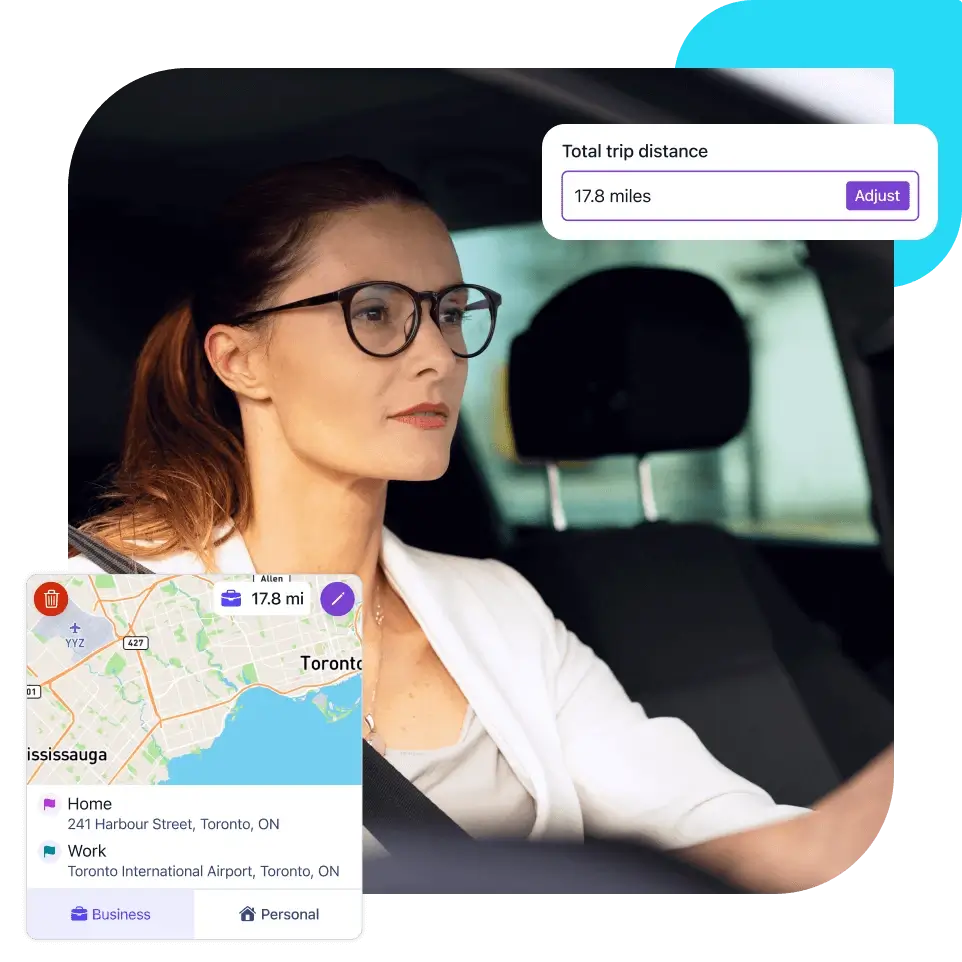

Recapture tax-waste and optimize your vehicle ops with outsourced program management, GPS mileage tracking and business intelligence reporting.

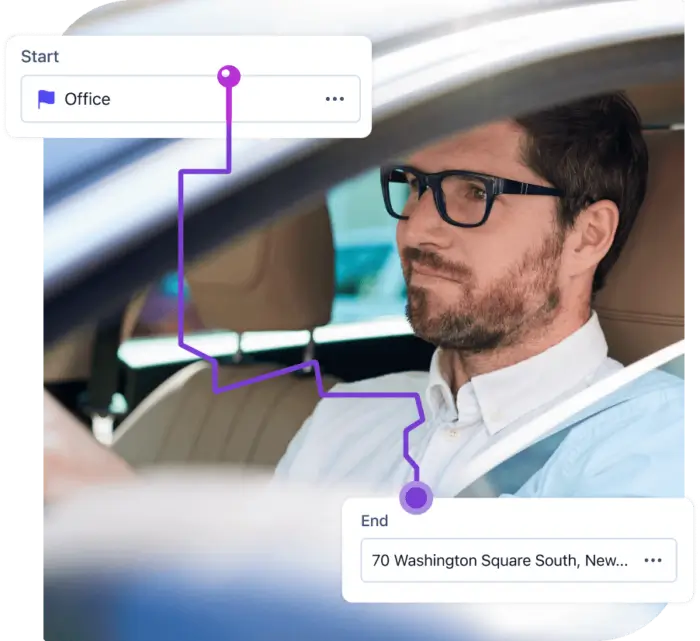

Learn MoreSales

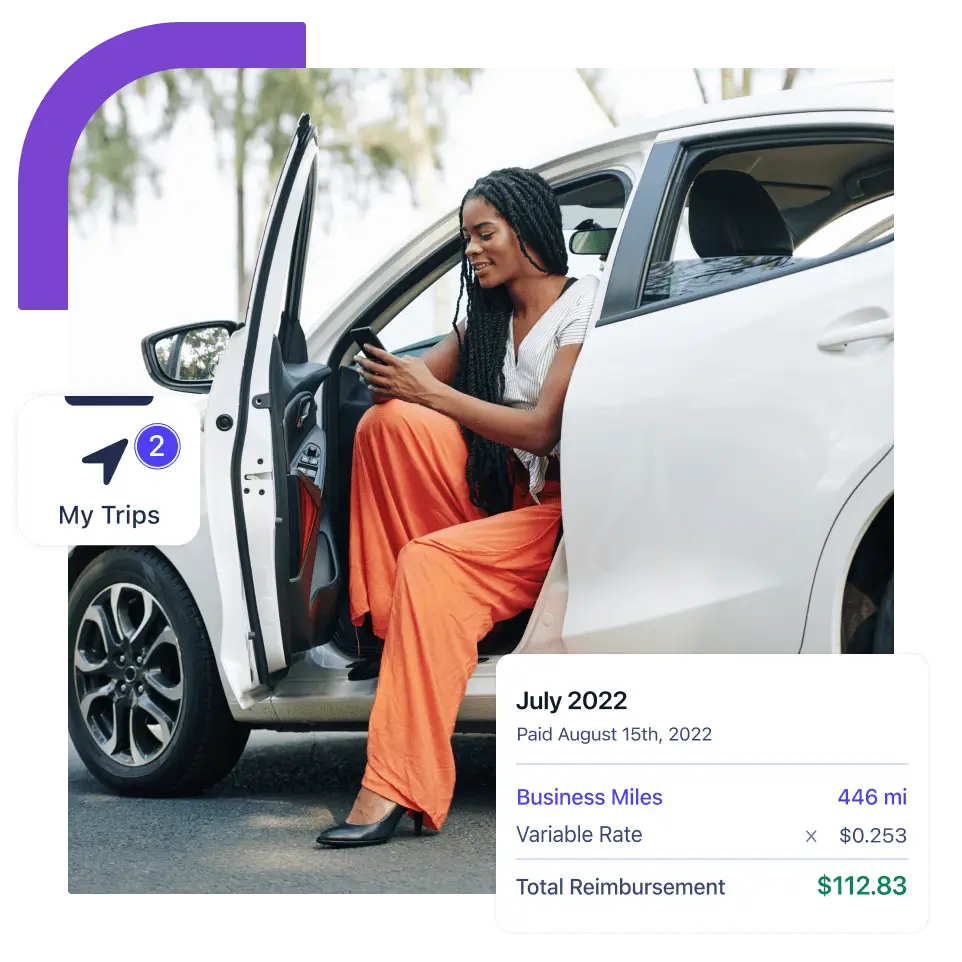

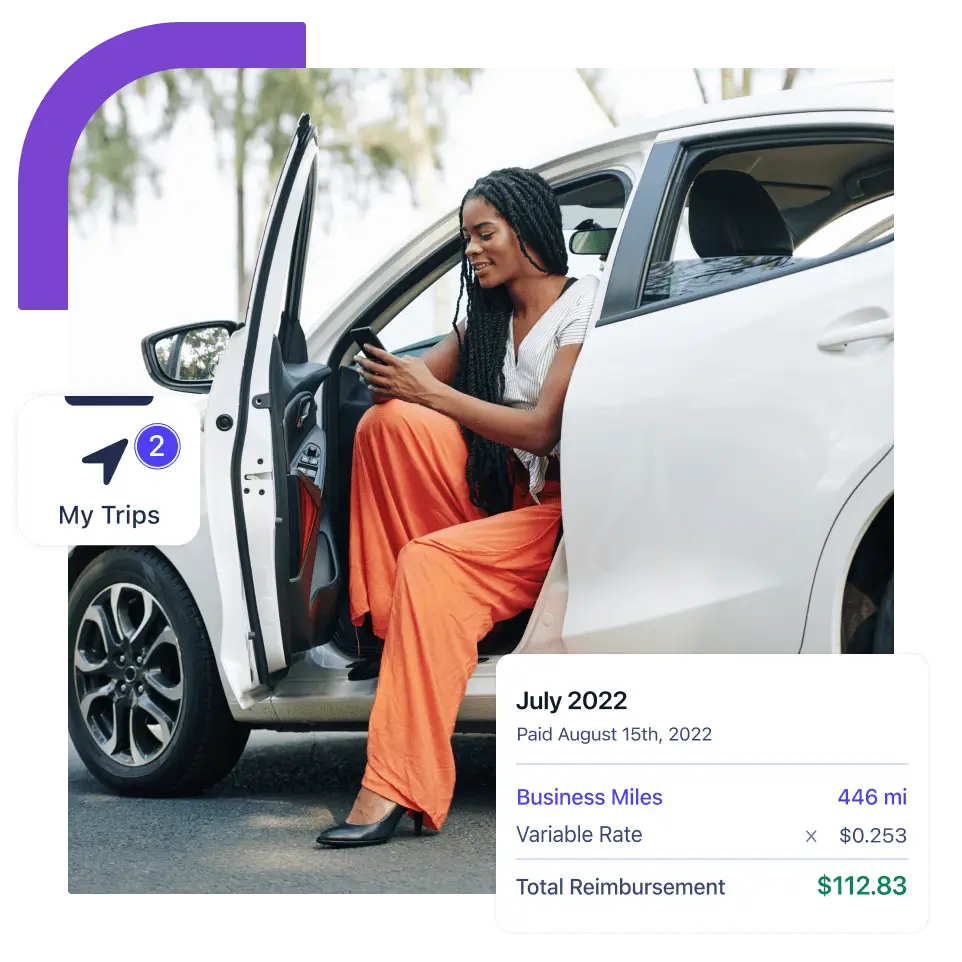

Offer your mobile sales team a vehicle benefit they’ll love: tax-free vehicle reimbursements plus software that takes mileage logging off their plate.

HR

Attract top talent then free up their time with a vehicle reimbursement benefit everyone will love. Wave goodbye to paper logs and shoeboxes of receipts.

Learn MoreProcurement

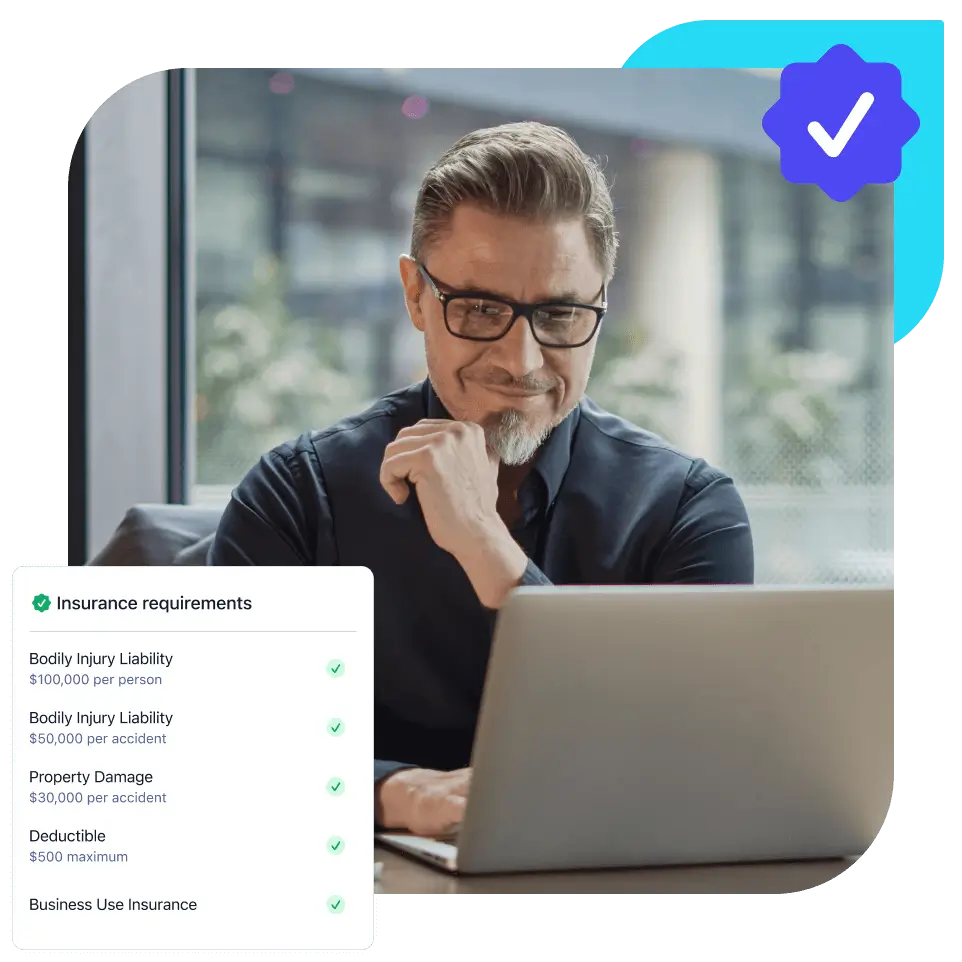

Get a fully-managed vehicle reimbursement program with transparent terms, reliable software and tax-efficiency.

What our customers are saying

Hear from companies on the positive impacts their vehicle programs make.

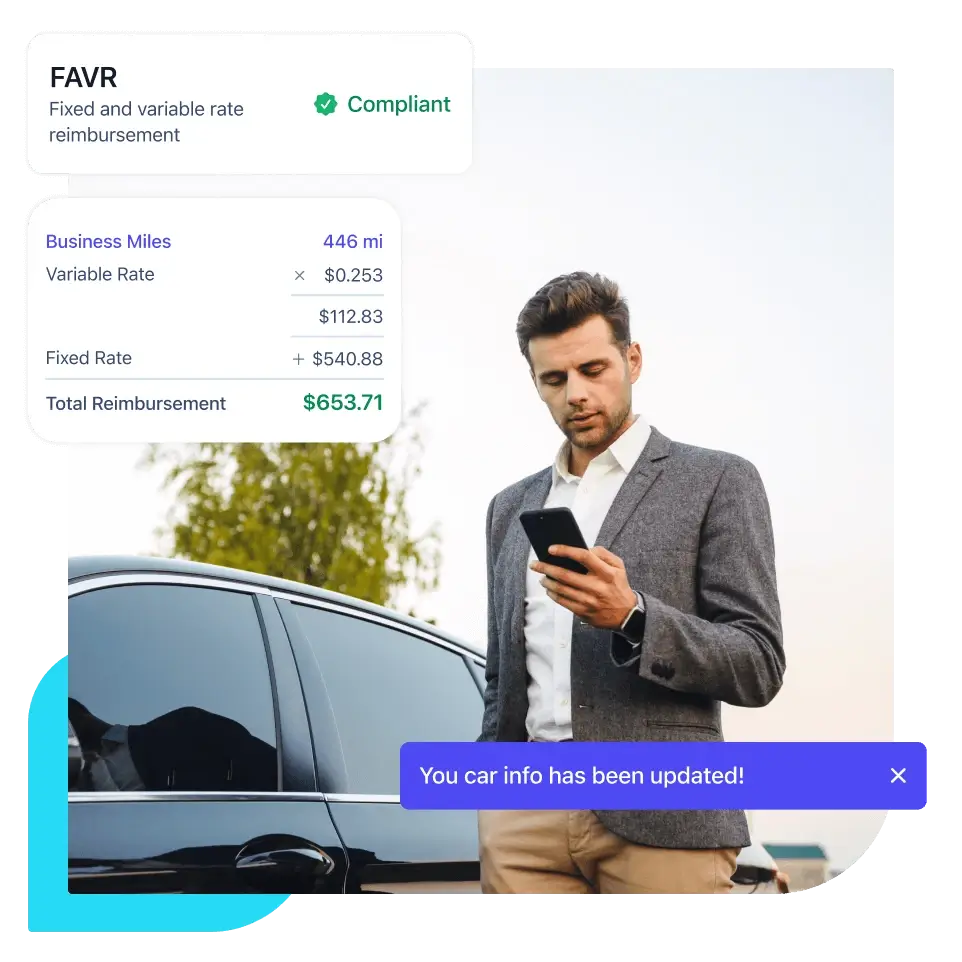

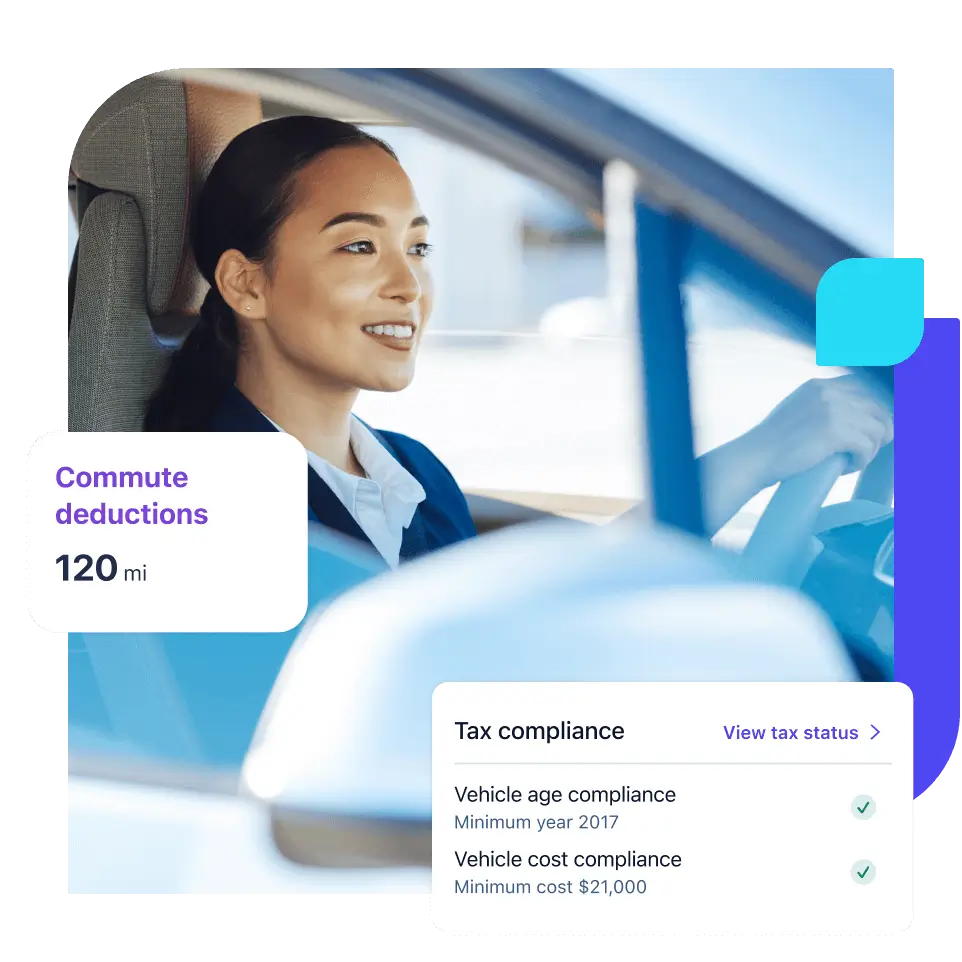

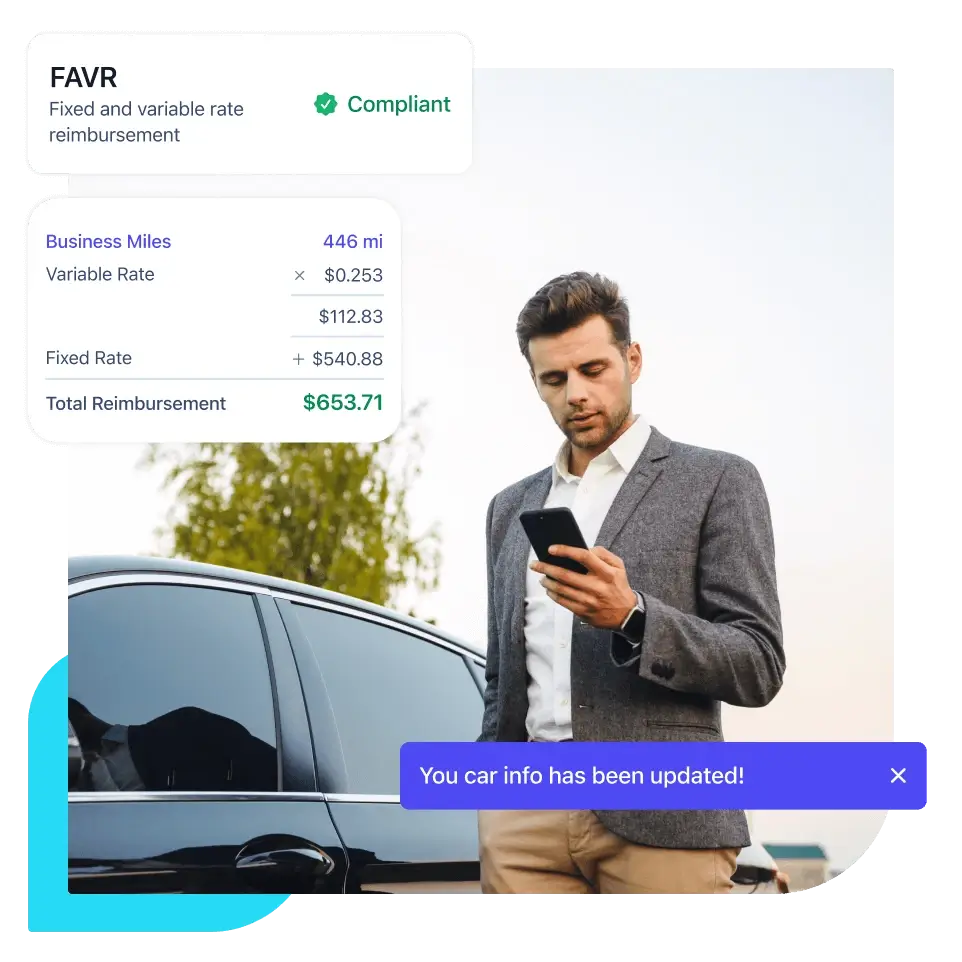

Vehicle Reimbursement Programs

Offer tax-efficient vehicle benefits, save your company and drivers time and money, and reduce corporate risk.

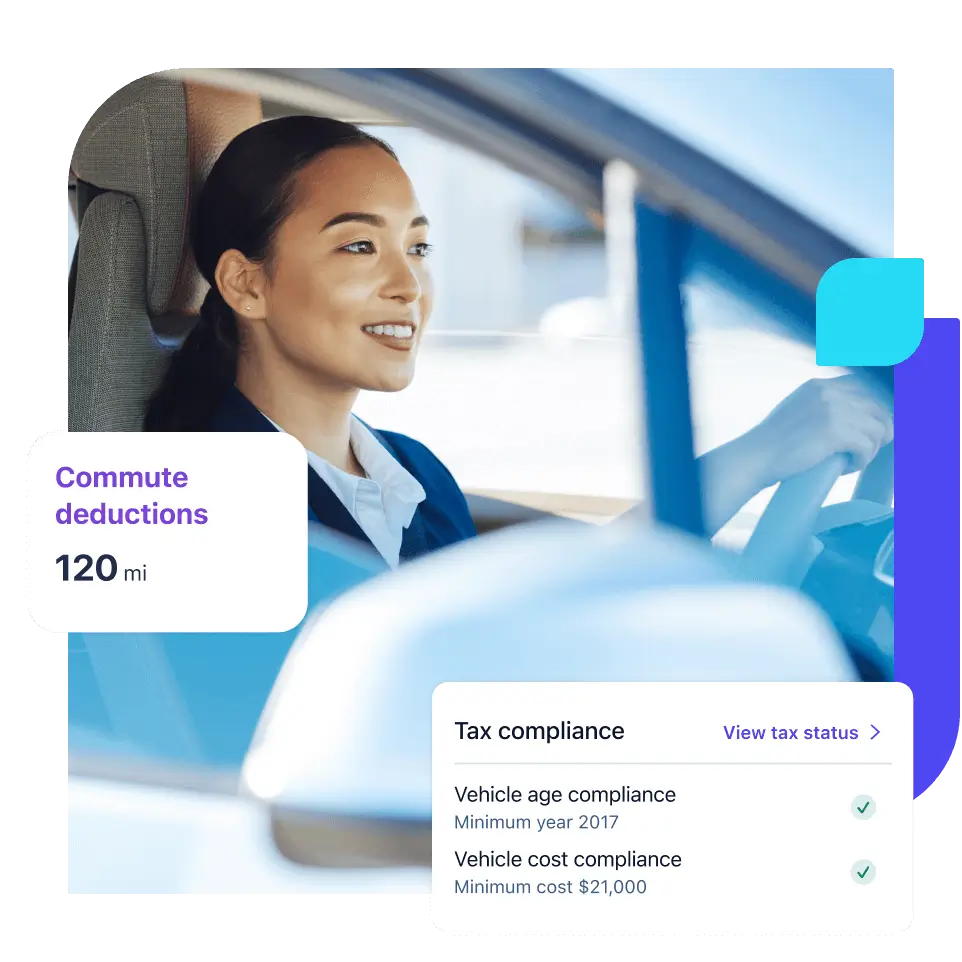

Make your vehicle program tax-efficient and risk-free with a benefit for employees who drive personal cars.

Bring transparency, reliability, and efficiency to your reimbursements with a fully-managed allowance.

Offer a simple CPM reimbursement, or combine it with another program to maximize efficiency.

Offer your Canadian employees a great benefit for the business use of their personal car.

Technology and services

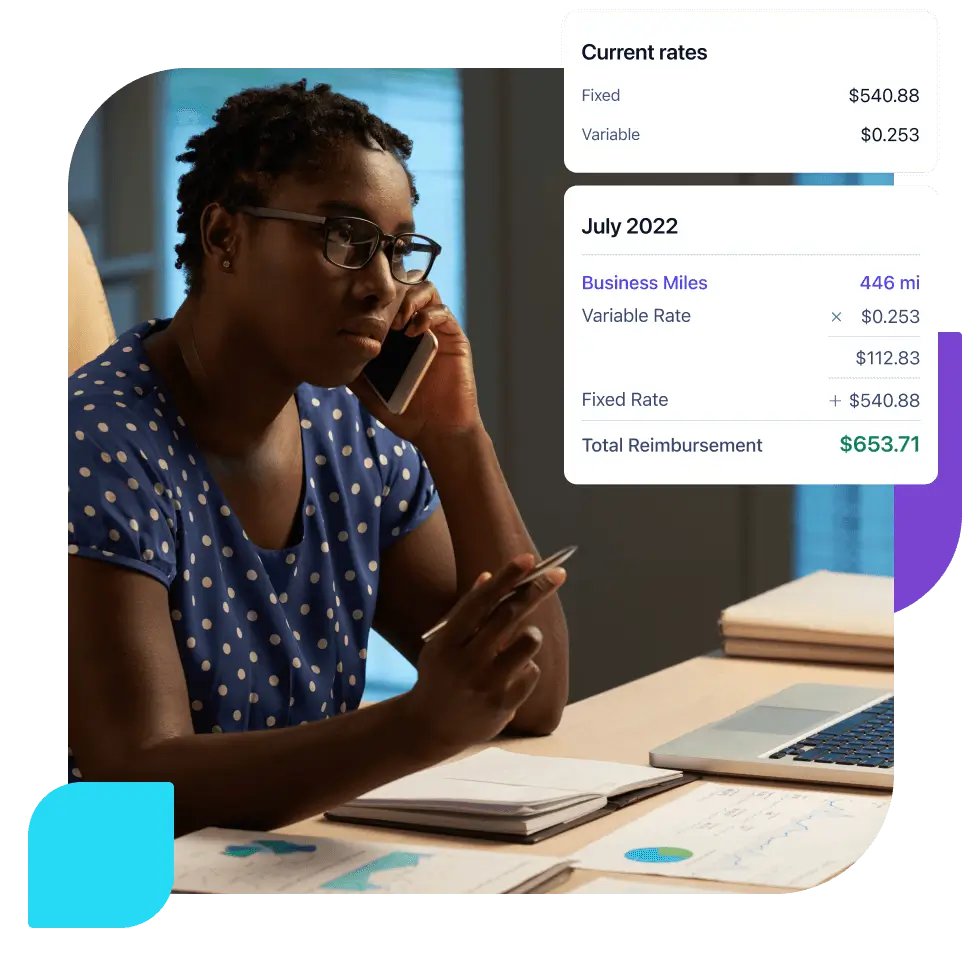

Approve mileage, budget monthly costs, and ensure compliance from your reimbursement command center.

Guide your decision making about your vehicle program with business intelligence reports.

The Cardata savings calculator

Find out what efficiencies await. Compute the future business benefits a new vehicle reimbursement program could bring.

Simplify administration

Reduce costs

Optimize vehicle operations

We’re ready when you are.

See for yourself why leading enterprises and SMBs trust Cardata with their vehicle reimbursement programs.

Book a demo